If you’ve attended another webinar promising that AI will “revolutionize procurement,” sat through one more vendor demo of features you’re not sure you need, or read another think piece about the “AI transformation,” you’re probably exhausted. The pressure to experiment with AI is everywhere, but the guidance on what actually works remains frustratingly vague.

Here’s what most of that noise misses: according to recent research surveying over 800 procurement professionals, 80% of teams have already moved past experimentation for one specific application—contracting. And they’re not just using AI for contracting; they’re rating its impact at an average of 8.3 out of 10.

This isn’t about chasing the next shiny tool or trying to stay ahead of a trend. The research data suggests that AI in contracting has crossed a threshold that other procurement applications haven’t reached yet. Understanding why this specific application works—and how to implement it systematically rather than experimentally—could save you months of pilots that lead nowhere.

Why contracting became procurement’s AI success story

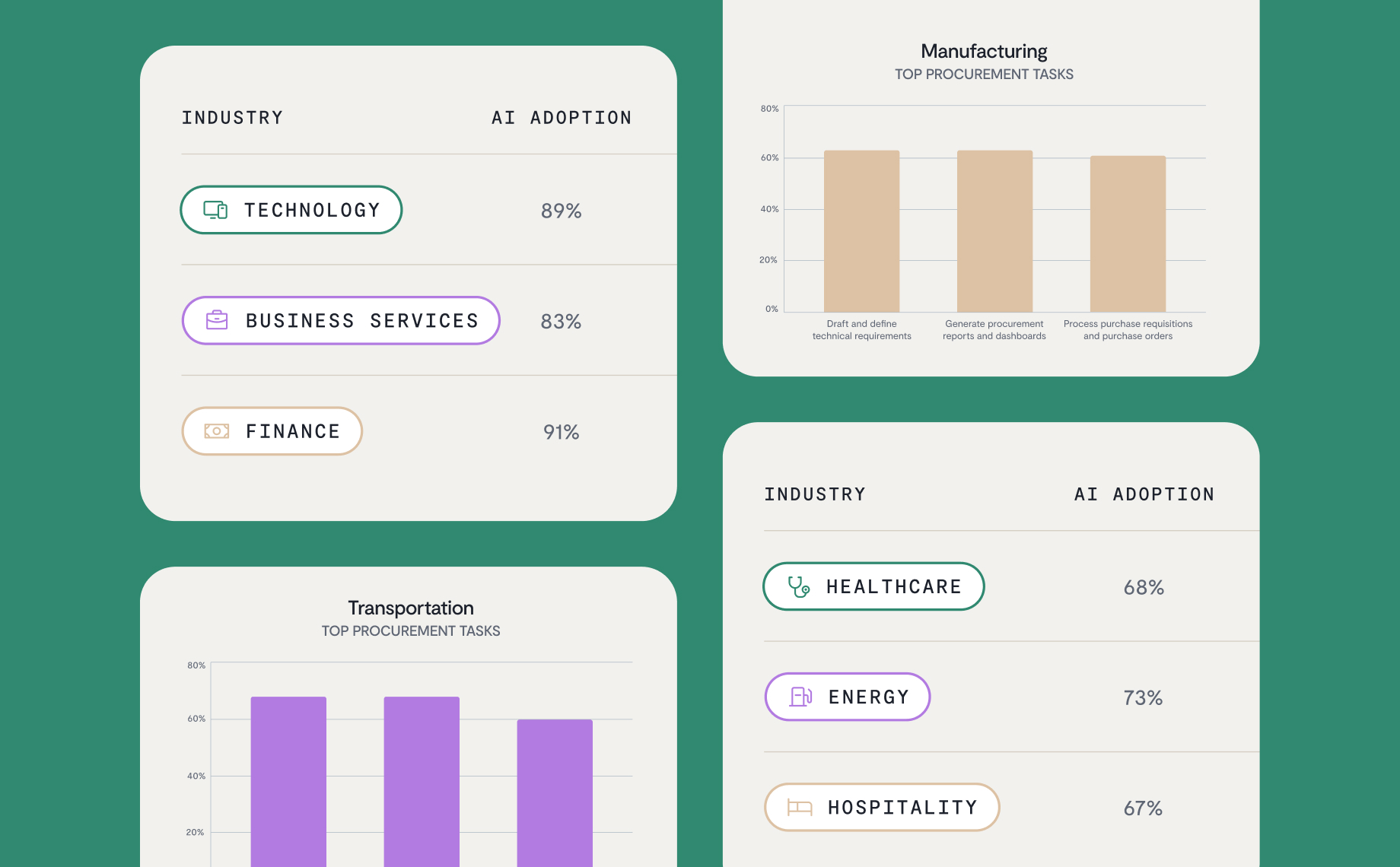

The 80% adoption rate matters less for the number itself than for what it represents about readiness and reliability. Gartner identified contract lifecycle management as the most mature and reliable AI application for procurement, and the research confirms this pattern holds across industries.

The benefit scores speak for themselves:

- Finance teams: 9.2/10 for contract insights

- Manufacturing teams: 8.3/10 for renewal tracking

- Technology companies: 8.8/10 for compliance monitoring

- Business services: 8.7/10 for risk assessment

This consistency might stem from what contracting provides that other procurement functions don’t: structured, accurate, essential data. Contracts are already organized documents with defined sections, standardized language patterns, and clear information hierarchies. They’re the definitive source of truth for supplier relationships, pricing terms, obligations, and commitments.

Compare this to spend analysis, where data quality varies wildly across ERP systems, or supplier discovery, where information is scattered across the internet in inconsistent formats. Contracting gives AI something concrete to work with, which might explain why the research shows teams seeing value faster and more reliably here than in other applications.

The three categories where AI delivers in contracting

The research breaks down how procurement teams actually use AI in contracting into three distinct categories, each addressing different operational needs and delivering measurable benefits.

Operational efficiency and automation

This category includes the routine but time-consuming tasks that have traditionally required manual review.

What teams are using AI for:

- Tracking contract expiration dates and renewals

- Managing approvals and intake requests

- Creating status reports

- Importing existing contracts into centralized systems

The standout application: Tracking and managing supplier contractual commitments—the research found it appears as the top use case across nearly all industries. This involves AI extracting specific obligations like volume discounts, rebate structures, service level commitments, and delivery terms, then monitoring whether suppliers fulfill these commitments.

Why it scores so high: The consistent scoring (often exceeding 8/10) might reflect that this application directly impacts measurable outcomes—dollars recovered through enforced rebates, risks mitigated through obligation monitoring, and relationship quality through supplier accountability.

Industry variations:

- Manufacturing teams rate renewal tracking at 8.3/10 (makes sense where missed renewals could halt production lines)

- Transportation companies score contract importing at 8.7/10 (data consolidation is their critical blocker)

Risk, compliance, and vendor management

This category focuses on AI applications that assess, monitor, and mitigate contract-related risks.

What teams are using AI for:

- Reviewing contract terms against company policies

- Monitoring ongoing compliance

- Assessing risks based on terms and supplier profiles

- Tracking commitments

Why technology leads here: The research reveals that technology companies rate compliance monitoring at 8.8/10, which could reflect an industry where service level agreement breaches directly impact customer retention and revenue. A single compliance failure can trigger contract terminations and customer churn, making proactive monitoring essential rather than just helpful.

Business services’ focus: According to the study, business services rates risk assessment at 8.7/10. This application analyzes contract language alongside supplier data like financial health, past performance, and market position to generate risk scores.

Lifecycle management

This category involves AI supporting active contract creation, negotiation, and modification.

What teams are using AI for:

- Generating contract insights

- Drafting new contracts

- Managing amendments and extensions

- Supporting negotiation processes

The most striking finding: Finance companies rate generating contract insights at 9.2/10—the highest score across all industries and all contracting AI applications. This involves AI extracting nuanced intelligence from contracts: obligation patterns, exposure analysis, opportunity identification, and trend recognition across portfolios.

Why finance excels here: It might reflect regulatory requirements that demand deep contract understanding for audit and compliance purposes, combined with governance structures mature enough to have already addressed the integration and data quality challenges that would prevent other industries from pursuing this sophisticated application.

Other industry priorities:

- Healthcare: 8.6/10 for contract insights

- Retail: 8.6/10 for relationship summarization (mapping how different contracts and entities relate to each other)

These variations suggest different industries prioritize different lifecycle applications based on their specific operational pressures—healthcare’s regulatory environment versus retail’s fragmented supplier ecosystems.

Addressing the concerns that keep teams experimenting

If 80% of teams are already using AI for contracting successfully according to this research, why do some procurement professionals remain hesitant or stuck in pilot mode? Based on conversations with procurement leaders who participated in follow-up interviews for the study, three concerns emerge repeatedly—and they’re worth addressing honestly.

Accuracy and hallucination risks

The concern: AI will extract incorrect information or identify obligations that don’t exist in contracts.

Why it’s valid: This risk is real and shouldn’t be dismissed.

Why contracting mitigates it: The structured nature of contracts provides built-in validation opportunities that other procurement applications don’t have. Unlike unstructured data where AI outputs are difficult to verify, contract AI can cite specific clauses, page numbers, and language that supports its extractions.

What works: Implementation approaches that require AI to show its work—pointing to exact contract language—substantially reduce hallucination risks while building user confidence.

Loss of human oversight and judgment

The concern: Contracts involve nuanced interpretation, relationship dynamics, and strategic considerations that genuinely do require human judgment.

Why it’s valid: This concern reflects good instincts about what procurement professionals bring to contracting relationships.

What successful teams do: The teams seeing the highest benefit scores in the research appear to position AI as augmentation rather than replacement. AI handles extraction, monitoring, tracking, and flagging—the time-consuming administrative work—while humans maintain decision authority on interpretation, exceptions, negotiations, and strategic choices.

The benefit: This division of labor lets procurement professionals operate more strategically rather than spending time on manual contract review.

Integration complexity and change management

The concern: Implementing AI for contracting requires integration with document management systems, workflow tools, and potentially performance monitoring systems.

Why it’s valid: This represents real work that shouldn’t be minimized.

Why it’s solvable: The 80% adoption rate the research uncovered suggests these integration challenges are solvable, particularly when compared to the fragmented system landscapes that plague other procurement AI applications.

Where to start: Applications that have manageable integration requirements—like renewal tracking or commitment extraction—build organizational confidence before tackling more complex implementations.

Moving from pilots to systematic implementation

The teams in the research that have moved beyond experimentation follow patterns worth replicating:

Start with high-value, low-complexity applications

Rather than trying to implement comprehensive AI across all contracting processes simultaneously, successful teams begin with one or two applications that deliver clear ROI without requiring perfect data consolidation.

What the research shows: Supplier commitment tracking and renewal monitoring work even with partially digitized contract repositories, making them accessible entry points that demonstrate value quickly.

Match applications to your industry’s pressure points

The variation in benefit scores across industries in the study reveals that not all applications deliver equal value in all contexts.

Industry-specific successes:

- Technology companies: Compliance monitoring (8.8/10)

- Finance teams: Contract insights (9.2/10)

- Manufacturing organizations: Renewal tracking (8.3/10)

Understanding which applications align with an industry’s proven patterns might accelerate success.

Build on proven foundations

The research data shows a logical progression: organizations that solve data consolidation through contract importing (transportation’s 8.7/10 application) can then pursue analytical capabilities.

The pattern: Teams that establish basic renewal tracking and commitment monitoring build organizational confidence that enables investment in more sophisticated applications like risk assessment and insight generation.

Establish clear governance before scaling

The research reveals that industries with highest adoption rates often have strong governance structures.

Finance example: 45% with extensive IT guidelines and 39% with extensive leadership guidelines don’t slow deployment—they appear to accelerate it by creating clear evaluation criteria and approval pathways.

What to document:

- Which applications require what level of human oversight

- How AI outputs will be validated

- What authority AI has to trigger actions

This prevents governance gaps from derailing implementation.

Measure impact using procurement KPIs

The benefit scores in the research reflect that teams are evaluating AI against actual procurement metrics.

What successful teams measure:

- Dollars recovered through enforced rebates

- Supply disruptions prevented through proactive renewal management

- Customer retention protected through compliance monitoring

- Audit performance improved through contract intelligence

Connecting AI performance directly to existing KPIs makes the business case clear and prevents AI initiatives from becoming technology projects disconnected from procurement outcomes.

The window for strategic advantage

The 80% adoption rate for AI in contracting might seem like evidence that the opportunity has passed—that this is now table stakes rather than competitive advantage. But the variation in benefit scores and application sophistication in the research suggests otherwise.

Many organizations are using AI for contracting, but not all are using it strategically.

What separates leaders from followers: The teams achieving 9+ benefit scores appear to have moved beyond using AI as a productivity tool toward leveraging it as strategic intelligence.

From automation to intelligence:

- Not just tracking renewals → using renewal patterns to inform sourcing strategy

- Not just extracting commitments → using commitment data to evaluate supplier performance and relationship value

- Not just monitoring compliance → using compliance trends to identify systemic supplier issues before they escalate

This progression represents the next competitive frontier. And it’s only accessible to organizations that move past experimentation and toward systematic, thoughtful implementation of applications that have already proven their value.

The experimentation phase served its purpose: it validated that AI can deliver real value in procurement, particularly in contracting. The 80% of teams in this research who are already seeing that value have done the proof-of-concept work. The question now is whether procurement organizations will learn from their success or spend another year piloting what’s already been proven to work.

Ironclad is not a law firm, and this post does not constitute or contain legal advice. To evaluate the accuracy, sufficiency, or reliability of the ideas and guidance reflected here, or the applicability of these materials to your business, you should consult with a licensed attorney. Use of and access to any of the resources contained within Ironclad’s site do not create an attorney-client relationship between the user and Ironclad.